First, despite the name, it is not about monitoring the health of rocks, particularly for those of you of a certain age who may still have in an attic a pet rock. You should care because this San Francisco-based digital health seed accelerator for startups in just a few short years has amassed what is arguably one of the most impressive digital healthcare ecosystems—including investors, startup founders, doctors, leading medical facilities, universities and a host of others—and has its finger squarely on the pulse of the future of modern medicine.

It is why you need to bookmark the site. It is also why its recently released Digital Health Funding Year in Review 2012 that is embedded below is worth a review. But first, here is a bit of a teaser to get you to look through the entire report.

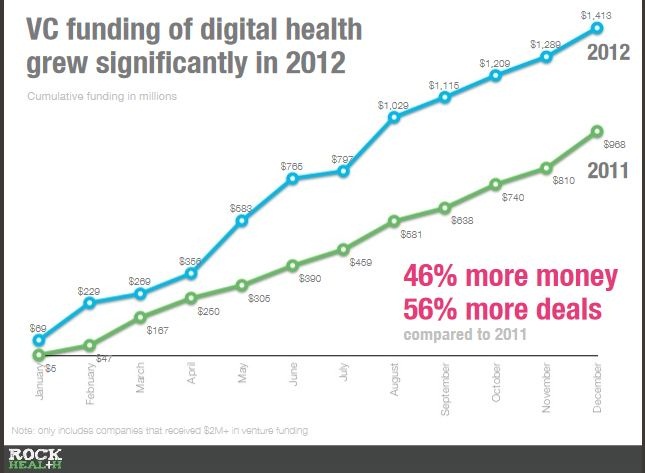

You read correctly. Despite all of the economic uncertainty out there the D-Health sector is hot. There was:

- 46 percent more money raised in 2012 over 2011

- 56 percent more deals in 2012 versus 2011

And, this contracts to the venture capital (VC) funding of biotech being down 4 percent, medical devices down 16 percent and medical software up 19 percent in the same time period.

Thanks to the wonders of technology Rock Health has made the report available via slidehare.net. This means you can view all of the nice graphics in the report. (Note: if you would like the database that is it foundation as well as a pdf. they are available for purchase from Rock Health).

I will briefly hit a few of the highlights along with some important links you may wish to capture include:

- 134 D-Health companies individually raised more than $2 million dollars in 2012

- Four common themes representing more than one third of all deals in 2012 were:

- Personal health tools and tracking $150M

- Health consumer engagement (helping consumers purchase products) $237M

- EMR/HER (capturing clinical info and surround apps) $108M

- Hospital administration $78M

- More than half of deals were rounds of $5M or more

- The largest five deals were more than 20 percent of year’s total funding

- Road to IPO looks good for Practice Fusion, Castlight and ZocDoc

- Of 179 organizations investing most did only a single deal

- Boston and Silicon Valley are D-Health startup hubs by wide margin

- Companies to watch include: pingmd, Wello, BreakThrough, and Beyond Lucid Technologies

- Women surprisingly remain underrepresented as D-Health CEOs

While there may be four key investment areas emerging, a quick look at the breath of activities covered in each and the scope of those already playing in these sand boxes illustrates why the field is ripe with opportunity and investment activity.

By all appearances 2013 is also shaping up to be a happy and D-Healthy new year as well.

Edited by

Rachel Ramsey